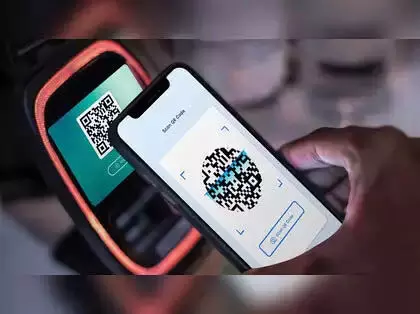

financial year 2023-24: The increasingly digital nature of our financial transactions demands robust payment security for all users, especially the youth, who are the future entrepreneurs of the country. Mastering digital security is now an essential skill. According to the Reserve Bank of India, digital payment frauds have increased fivefold in the financial year 2023-24. This trend also highlights the critical need for greater awareness about payment security among young entrepreneurs. On this World Youth Skills Day, Visa is sharing simple tips to help young adults and entrepreneurs develop secure practices to protect themselves from payment scams. Choose secure payment methods to avoid fraud When shopping online, prefer tokenized payment options. Tokenization generates unique transaction codes instead of sharing your card details, reducing the risks of a data breach. As a young entrepreneur, using secure payment methods during your e-commerce journey increases customer trust. Since its introduction, tokenization has been widely adopted across the country. By November 2023, India had issued over 560 million tokenized cards, demonstrating its commitment to secure transactions.

Beware of AI-based scams

Scammers use AI to create fake and convincing websites, emails, and phone calls. Scams like phishing often target young adults and steal personal information like passwords. As an approach, you should always check the URL before entering information and avoid clicking on suspicious links in emails or text messages. Be wary of unsolicited calls or messages that ask for personal details, card credentials, or OTP/PIN/password.

Detect fraud quickly with Transaction Alerts

Enable transaction alerts through apps to stay updated on account activities. These alerts notify you whenever your card is used, helping you detect suspicious activity quickly. Review your account statements periodically for unauthorized charges. As an entrepreneur, transaction alerts help you track business finances and identify potential fraud attempts.

Always verify the authenticity of communications

According to Visa’s ‘Fraud: The Language of Fraud’ report, four out of five people focus on deceptive details like logos and slogans when checking the authenticity of communications, which can be easily manipulated by fraudsters. Surprisingly, less than half of people guarantee the correct spelling or verify order numbers with the companies they have dealt with. To stay safe, pay attention to these small clues and confirm the legitimacy of any communication.

Seek help from trusted authorities

If you are a victim of a scam despite safe practices, immediately report it to your bank and government authorities for further investigation. Contact the National Cyber Crime Helpline by dialing 1930 and lodge a complaint on the National Cyber Crime Reporting Portal (NCRP). Share your experiences with colleagues, family and seniors to raise public awareness and protect others.

By equipping themselves with these essential payment security skills on World Youth Skills Day, young entrepreneurs can navigate the digital landscape with confidence. This proactive approach will protect your businesses and contribute to a safer digital ecosystem for all.