New Delhi: The Central government has introduced a new pension scheme, the Unified Pension Scheme (UPS) which will come into effect from April 1, 2025. In UPS, the government has offered several advantages of the previous Old Pension Scheme (OPS) like assured pension, family pension and indexation benefits.

This pension scheme is only for government employees unlike New Pension Scheme (NPS) which is offered to both government and private employees. Now government employees will have the option to choose between the UPS and the New Pension Scheme (NPS) to get a pension. The Old Pension Scheme is also applicable to government employees in some states.

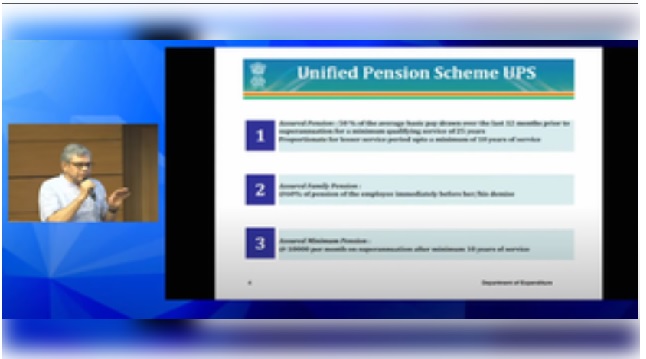

Let’s understand UPS first. Under the Unified Pension Scheme (UPS), pension would be given to government employees by the Central government:

If a government employee retires after serving for 25 years, 50 per cent of his basic salary for the last 12 months will be given as a pension. The special thing about this scheme is that it has provisions for an assured pension. If a government employee works for 10 years, at least a Rs 10,000 pension will be paid by the government with indexation benefits.

In UPS, there is also a provision for family pension. If the employee dies after retirement, his family members will receive 60 per cent of his pension. A lump sum amount (apart from gratuity) will also be given on retirement in UPS. It will be calculated as one-tenth of the basic salary and dearness allowance (DA) for every six months of service.

More than 23 lakh Central government employees will benefit from this. Recently, Union Minister Ashwini Vaishnaw made a post on social media regarding the benefits of UPS, based on which we have compared UPS, NPS and OPS.

Difference between UPS, NPS and OPS:

*UPS is only for government employees. NPS is for both government and private sector employees. OPS was also for government sector employees.

*In UPS, 50 per cent of the average basic salary of the last 12 months will be given as a pension after retirement. There was no provision for a guaranteed retirement pension in NPS, whereas, in OPS, 50 per cent of the last basic salary was given as a pension.

*UPS and OPS is a secure scheme. However, NPS is linked to the stock market.

*Like NPS, in UPS, 10 per cent of the salary (Basic + DA) will be deducted. However, the government’s contribution to this will be 18.5 per cent, earlier it was 14 per cent. There was no deduction in OPS.

*UPS has a provision for a lump sum amount on retirement, which will be calculated as one-tenth of the employee’s basic salary and dearness allowance for every six months of service. In NPS, out of the total amount deposited during service, 60 per cent could be withdrawn in a lump sum on retirement and 40 per cent could be kept for annuity.

*In UPS and OPS, no investment has to be made to get a pension, whereas, in NPS, 40 per cent of the fund has to be invested for a pension.

*The benefit of indexation in pension is available in UPS and OPS. However, this benefit is not available in NPS.

*Assured minimum pension of Rs 10,000 per month on superannuation after a minimum of 10 years of service in UPS. There is no such provision in NPS, whereas in OPS there is a provision for 40 per cent pension commutation. (IANS)